A business deals with customers, wholesalers, retailers, Suppliers and many such business parties on a day-to-day basis. You need to create party ledgers to record transactions that you make, which may involve Sales , Purchase, Receipts or Payments, or Sales or Purchase from these parties.

To create a Party Ledger:

1. Go to Gateway of Tally > Accounts Info. > Ledgers > Create.

2. Enter the Name of the Party ledger

3. Select Sundry Creditors / Sundry Creditors from the List of Groups in the Under field.

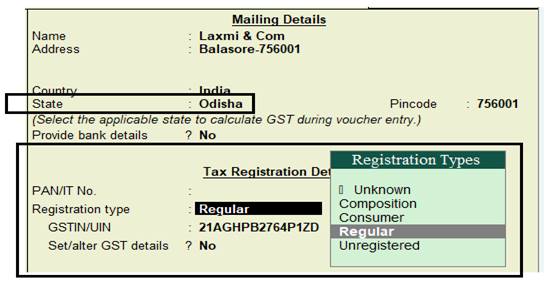

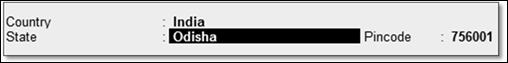

4. Set the option Inventory values are affected? to No,.

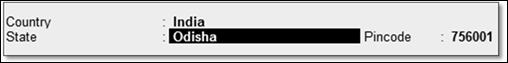

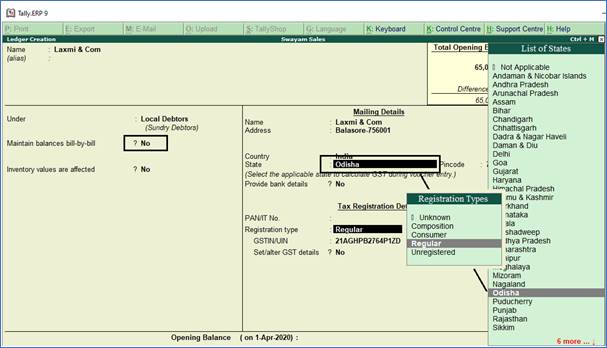

5. In Mailing details, the State is your default local State. You can change name of State from the State List if your Suppliers belongs to Outside State.

6. Enable the option Set/Alter GST Details? to open the GST Details screen.

-

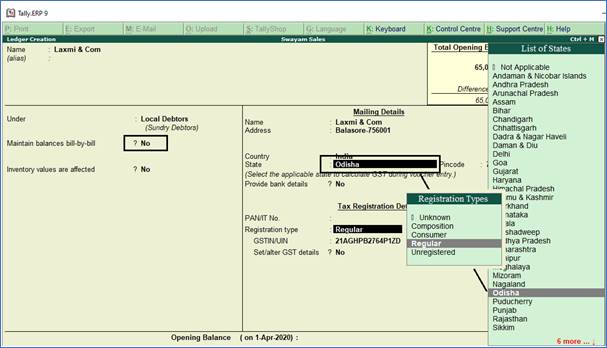

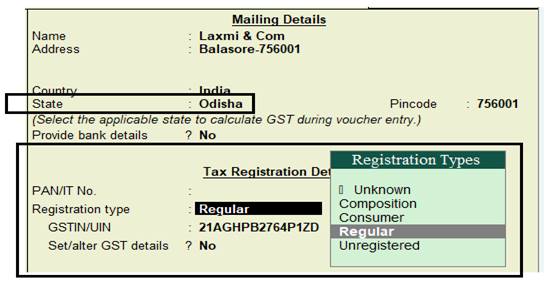

Select the relevant Registration Type from the List of registration Types.

-

Enter the 15-digit GSTIN or UIN issued by the tax authority.

-

If the supplier is an e-commerce operator, then enable the option Behave as e-Commerce Operator?

The GST Details screen appears as shown below:

The Ledger Creation screen displays as shown below:

Important Points:

-

GST involves within State (Local) and Outside State (Outside).

-

GST within State transactions are classified into CGST & SGST & Outside State transaction is IGST.

-

Tally.ERP9 will select CGST , SGST (with state transaction) or IGST (outside State transaction) on the basis of Party Ledger Address i.e. State & Party Registration type i.e. Composition or Consumer or Regular or Unregistered. If Party is Registered either under Composition or Regular, then GSTIN / UIN No. has to be mentioned. Tally.ERP9 will validate the GSTIN / UIN No. on the basis of State selection under Mailing details.

-

So the most important part at the time creation of Party Ledger is its selection of State in Mailing Address and type of Registration under Tax Registration Details as per screen below:

- Tally.ERP9 will calculate GST automatically on the basis of GST Rate given in Items & Goods in case of Accounts with Inventory and in case of Accounts only GST Rate given in Sales or Purchase Ledger:

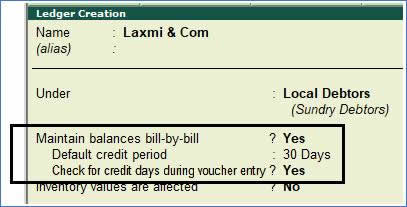

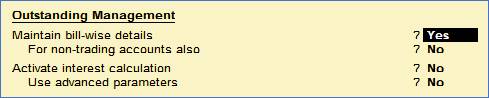

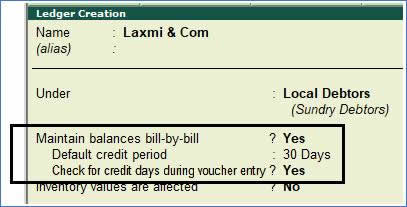

1. Maintain Balances Bill-by-Bill & Default Credit Period (if you require) :

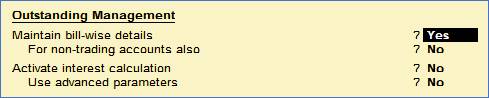

This functionality is available only, if you have Set Maintain Bill-wise details to Yes in F11: Features > F1: Accounting Features.

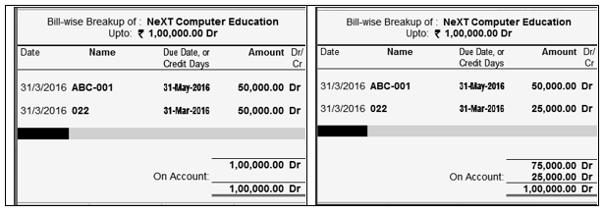

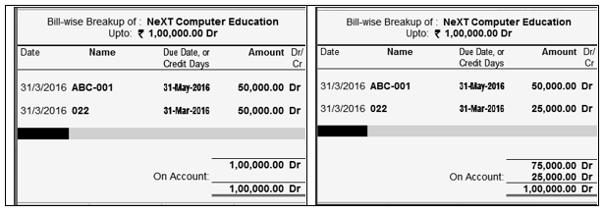

This option is applicable when you want the balances to be maintained Bill by Bill or Bill wise. Normally, this option is useful for Ledgers falling under Sundry Debtors & Sundry Creditors. If you set this option to Yes, while entering the opening balance in the Opening Balance field at the end of Ledger Creation screen and press Enter, the Bill-wise Breakup screen of the Ledger created is displayed as shown.

If the total amount of all your bills covers the Opening Balance, the On Account becomes NIL. You could have Bills totalling beyond the Opening Balance. In the screen shown above, there are two bills 50,000, 25,000. Now, if the balance brought forward is 1,00,000/- , the On Account amount will reflect 25,000/-. If you obtain the bill particulars at a later date, you can alter the ledger to enter these details, which will nullify On Account.

2. Define the Default Credit Period:

The credit period may be given for Sundry Debtors and Sundry Creditors. The number of credit days or period can be defined in various ways:

|

Suffix |

Example |

Days |

None |

5 is considered as 5 days. |

Weeks |

W |

5 W is considered as 5 weeks. |

Months |

M |

5 M is considered as 5 months. |

Year |

Y |

5 Y is considered as 5 years. |

Set the option Check For Credit Days During Voucher Entry to Yes to get a warning message when the party ledger selected in a transaction has exceeded the credit period, and outstanding bills have not been cleared. The warning message appears as shown below:

This will ensure that there is better control over credit period and outstanding amounts to be received and paid.

3. Cost Centre Options:

To get the option Cost Centers are applicable? in the Ledger Creation screen, you have set Maintain cost centres to Yes in F11: Features > F1:Accounting Features.

1. Enable the Cost Centers are applicable? option, if any of the transactions need to be allocated to any particular cost center (which involves this ledger).

2. Enable the Activate Interest calculation option to enable interest calculation automatically based on the interest rate and style of calculation specified.

3. Enable the Use advanced parameters option to enable the advanced parameters for interest rates that change from time to time. |